How much are property management fees?

New to owning an investment property, or considering taking the plunge?

If you’re renting out your property, your options are to handle the day-to-day management yourself, or hire a professional property manager to do it. By doing it yourself, you save on rental agent fees, however, you take on the time commitment and risks yourself. Rental costs for landlords vary, but hiring a professional saves time and money in the long term.

So what are property management fees? How much does a property manager cost? And what do you get for your money? Monika Minko, Senior Leader of Independent Property Management, shares her insights on how property management fees are structured, what you can expect to pay and why it’s an investment that pays off.

How to compare property management fees

How much is property management? It’s not as simple as a single number or percentage.

Property management fees are generally divided into a few categories. There is the:

- ongoing management fee

- property management leasing fee

- a range of miscellaneous fees and charges.

When you compare property management fees, make sure you understand what services are included in each fee quoted. Otherwise, you may not be comparing apples with apples.

“Some companies will offer an all-inclusive fee,” explains Monika “That means that they’re bundling the cost, often including a letting fee into the monthly charge, instead of charging for it separately as it arises.”

Which structure is better?

“It really depends. Some owners prefer an all-inclusive fee, because they can budget more accurately. Others prefer to separate out the property management and letting fee. When companies bundle them together, they work it out on the basis that you’ll need a new tenant say at every twelve months. If you have higher turnover than that, you’ll save money. If you have the same tenant for two or three years, you’ll end up paying more.”

The most common approach is still to charge a property management fee, letting fee and ancillary costs separately. In fact, although Independent offers both an all-inclusive and separate fee structure, the vast majority of owners choose the latter.

Real estate letting fees

A real estate letting fee pays for all the work associated with getting a new tenant for your property. It is generally a flat fee based on your asking rent. Some companies will include the marketing costs in the letting fee, whereas others charge it separately.

How much is a letting fee?

“A standard letting fee is usually one week’s rent, although it can be one and a half. Marketing packages are really varied. They might include 3D floor plans, photography, signboards, social media and more. Marketing might cost from $100 up to $800 - it really depends a lot on the agents recommended strategy and the property."

“If it’s a high-end property, or the owners are having trouble finding a tenant, we might recommend a targeted social campaign to reach a wider audience. That adds to the cost. At the moment, there’s a very strong market for rental properties in Canberra, so costs can be kept down.”

For your combined letting and marketing fees, your property manager will usually:

- Come up with a marketing campaign

- Arrange photography and write a listing advertisement

- Arrange advertising and marketing including signage

- Respond to queries from prospective tenants

- Organise inspections and attend the property to show prospective tenants around

- Receive and assess applications, including credit and reference checks

- Negotiate the terms of the lease and arrange for the contract to be signed by owner and tenant

- Conduct the initial inspection once a tenant has signed, including thoroughly documenting the property’s condition with detailed photographs (although this is sometimes charged separately)

Ongoing property management fee

Once you have a tenant secured, your property manager will handle the ongoing management. For this, they charge a property management fee. The fee is usually a percentage of the rent collected.

Just like in other parts of Australia, property management fees in Canberra vary.

“In Canberra, there’s a huge range,” says Monika. “Fees can be as low as 4%, or as much as 11%. Then there are ancillary fees on top. If it’s an all-inclusive fee, you may be looking at 16% or more.”

The property management fee pays for your property manager to:

- Collect the rent

- Follow up on arrears

- Pay water bills and recover the money from the tenant. If you have negotiated that the tenant pay any other utility bills, the property manager will pay and recover these amounts as well.

- Pay council rates, strata levies and other ongoing costs on your behalf

- Conduct regular inspections and document the property’s condition

- Respond to maintenance requests and organise any repairs. When you hire your property manager, you can set expectations for when they contact you about repairs. Some owners prefer to be asked for approval for any maintenance requests, whereas others are happy for the property manager to just go ahead and arrange them if they fall under an agreed limit.

- Liaise between owner, tenant and (if applicable) strata company

- Keep up to date with relevant legislation and communicate any changes to both tenant and owner so that they know their rights and responsibilities.

Ancillary fees

Some companies will charge extra for tasks that only come up from time to time. Others will roll it into their ongoing property management fee. Extra fees might be charged for any or all of the following:

- Administration fee - this covers postage, photocopying, document storage and other costs associated with administration. It is often charged monthly.

- Renewal fee - leases are generally for one year. When it comes time to renew the lease, your property manager will advise you whether the rent should be raised and revisit the other terms and conditions. All parties then need to sign a new contract.

- Advertising fee - the amount charged by various platforms such as real estate website or newspapers to carry your advertisement, plus costs incurred to hire professional photographers, copywriters or stylists. Some agencies bundle this with the letting fee, but it is more often separated out.

- Inspection fee - while this is often covered by all-inclusive fees, some companies separate it out. This can be useful if you prefer less frequent inspections.

- Fees to attend at the Tribunal and/or prepare for a tribunal hearing. In the rare event that a dispute arises with a tenant and you can’t resolve it informally, your property manager can attend the Tribunal with you or on your behalf. They will also put together a file of evidence to support your case: for example, to show how often rent has been late, or photographs showing damage to property.

- Insurance claim fee

- Maintenance project fee - this may arise if the property needs substantial work and your property manager has to regularly liaise with tradespeople and/or attend the property

“Even when companies offer an all-inclusive fee,” says Monika, “some of these charges will be extra. Tribunal attendances or maintenance project fees, for example, come up infrequently. It doesn’t make sense to bundle them together with the ongoing property management fee."

For this reason, make sure you understand what your fees are paying for even if you’ve gone for the all-inclusive option. Your property manager should provide you with a list of all fees before you sign a contract. Also, GST is payable on property management fees, so make sure that you understand whether GST is included in the quoted price or whether it will be charged on top.

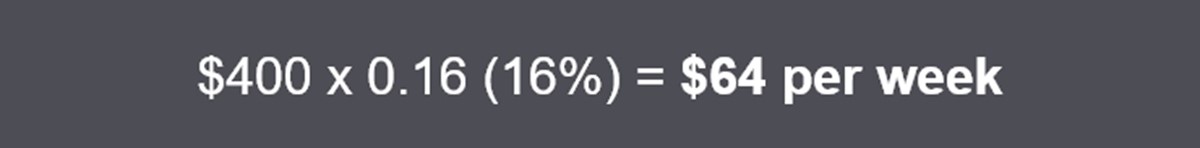

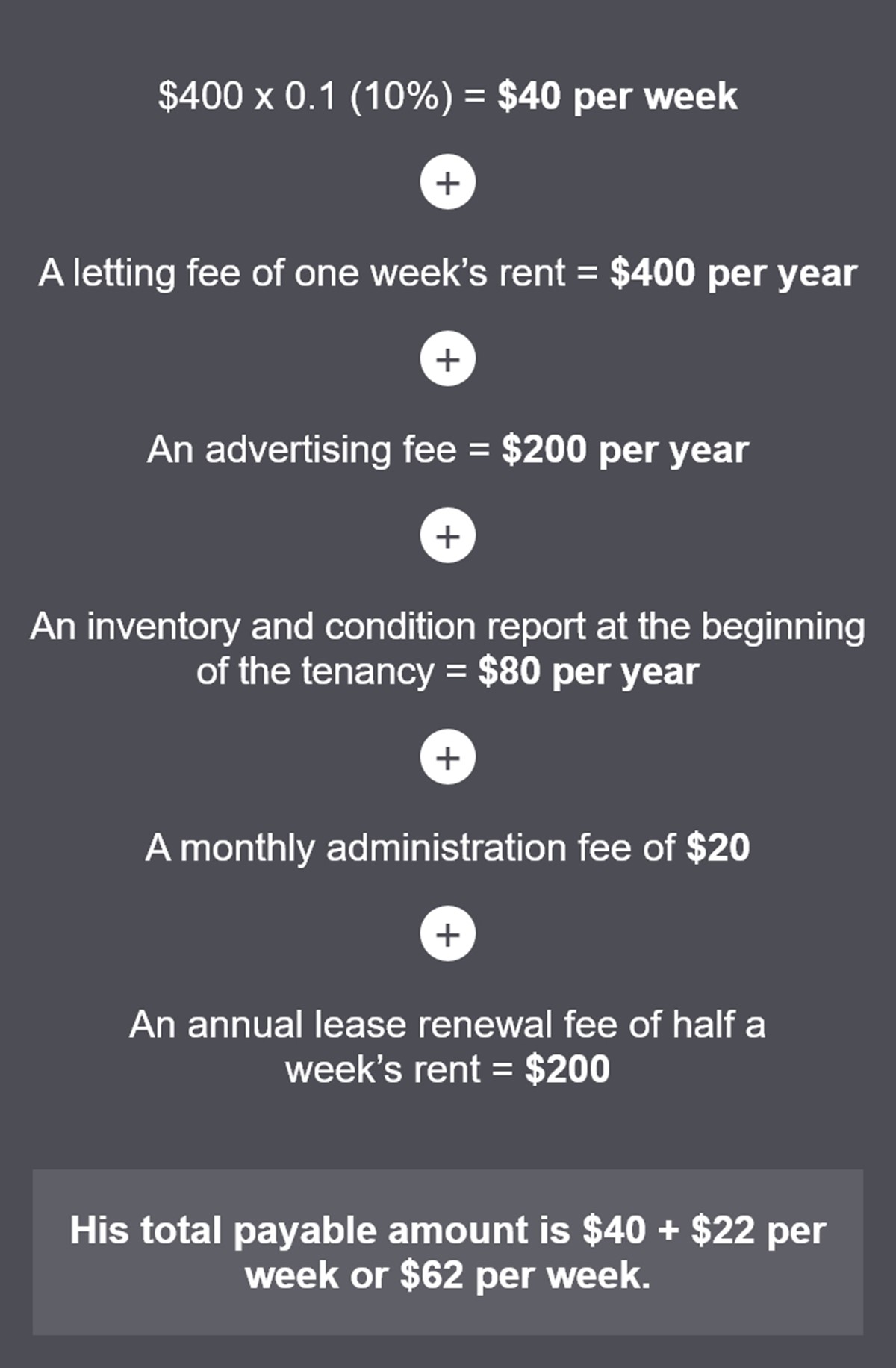

Ahmed owns an investment property which will be leased out at $400 per week. He is considering two different property management companies.

The first company, Adam’s All-Inclusive Property Management, charges an all-inclusive fee of 16%. A simple property management fee calculator tells Ahmed that he will be paying:

The second company, Belinda’s Bespoke Property Management, charges a lower property management fee of 10%. They also charge for various ancillary costs. By going with this company, Ahmed will be paying:

By taking the second option, Ahmed’s total cost is slightly lower per week. This cost will increase if he has a high turnover of tenants (more than one per year) and decrease if he has a long term tenant. This is why some landlords choose to sign long term leases.

Is cheaper always better?

Even when you’ve added up all the different fees, property management costs can vary considerably. Monika warns against choosing the cheapest one out there.

“You have to look at the company’s motivations,” she says. “A company charging a very low fee can’t break even. They’re likely either building their rent roll to on-sell it, or they’re inexperienced. Either way, you risk high property manager turnover and inconsistent service, plus the chance of being handed over to a different agency as part of a rent roll sale.”

Can I manage my property myself?

Of course, you can choose to save money by managing your property yourself. If you’re an experienced investor with a lot of free time, and you’re confident that you understand the legislation and you live nearby, it can be a great choice.

Before you head down that path, make sure you know what’s involved. You’ll need to be able to advertise your property yourself, vet suitable tenants, handle the paperwork, collect the rent and make sure that everyone involved is living up to their obligations. For you, that includes undertaking repairs and honouring tenants’ rights according to your state legislation. Their responsibilities include taking good care of the property, paying their rent on time and communicating if anything changes.

“People don’t always realise how hard it is to manage a property,” Monika says. “I get calls every week from private landlords who are looking for help. Their tenants are in arrears, or their property has been trashed. Sometimes there are different people living there than the person they leased to. There are all sorts of problems that can arise – and not to say the same can’t happen with a property manager in place, but a property manager has the time and resources to effectively mitigate and manage this sort of risk.”

How property managers can save you money

For most investors, having professional property managers will help maximise your investment and make you more money. They’ll also reduce your stress.

- They keep up to date with tenancy laws. As trained professionals, property managers know the rights and responsibilities of both tenants and landlords. They know what documentation needs to be kept and have a regular schedule for administrative duties. “As people become more litigious,” says Monika, “it’s becoming more and more important to be across changes in legislation. That can be tough if you’re self-managing, especially when a raft of changes all come into effect at once."

- They’ll take complaints off your plate. When a tenant complains about your property, it can be hard not to react emotionally. A property manager doesn’t have the same emotional attachment. And even if you don’t mind dealing with complaints, how do you feel about it at two in the morning?

- No more chasing after the rent. Would you know what to do if your tenant defaults on their rent? Chasing rental arrears can be time consuming and distressing. Property managers have systems in place that make the process more efficient, and screening procedures which help ensure good tenants in the first place.

- Professional help to price your property correctly. Setting your rent at the right level is essential to maximise income. Too high and you risk scaring tenants away. Every week that the property is vacant means lost income for you. Too low and you’ll be losing money every single week. A property manager brings their experience to work for you. They can give you expert advice on where your property sits in the rental market and how to price it.

- Property managers attend to routine repairs promptly and are proactive about maintenance. “One huge advantage of a property manager is that we take a wholistic view,” Monika says. “For example, in an apartment complex, if one owner’s hot water system needs replacing, we know that our other owners might need to replace theirs as well and we can alert them ahead of time. If you’re a private landlord, you won’t have the benefit of that broader view.” Find out more about how proactive maintenance can maximise your investment here.

Hiring a property manager is a solid investment in your future. Get in contact for a free rental appraisal or visit our services page for more information about how we can help make you money.

Have you considered short-stay?

Find out how Airbnb could increase returns by up to 30%

Get more from your investment

We want to help you get more out of your investment and are sure that no matter what sort of property you are thinking of leasing out, we are up to the task.

Drop us a line to learn more about how we can help.